New Florida Law Strengthens Protections Against Moving Scams

New Florida Law Strengthens Protections Against Moving Scams As Florida's population continues to grow, the state has implemented a new law designed to protect consumers from fraudulent moving practices. Effective July 1, this law requires all movers and moving brokers to register with the state, en

Read More

The New Era of Real Estate: Why You NEED and WANT a Buyer Representation Agreement

The New Era of Real Estate: Why You NEED and WANT a Buyer Representation Agreement The real estate landscape is ever-evolving, and with it, the ways buyers navigate the market. One significant change is the increasing emphasis on buyer representation agreements and commission transparency. Unless yo

Read More

Understanding Your Southwest Florida TRIM Notice: A Homeowner's Guide (Lee & Collier Counties)

Every August, Lee and Collier counties in Southwest Florida send homeowners TRIM (Truth in Millage) notices. Understanding this document is crucial to managing your property tax bill. It provides valuable insights into your property's assessed value and tax obligations. What is a TRIM Notice? A TRIM

Read More

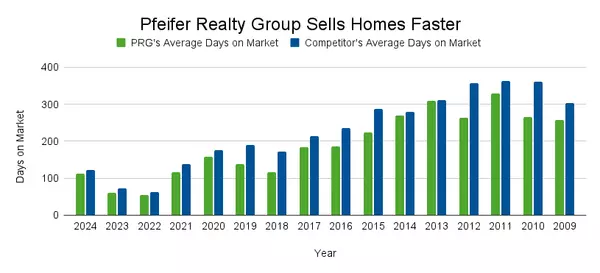

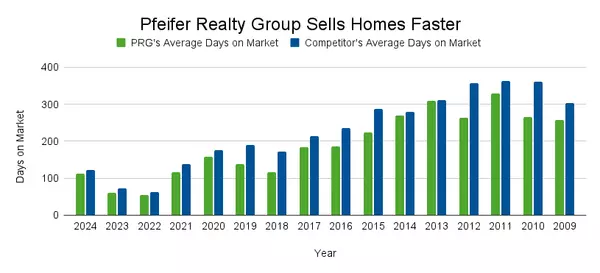

Why Work with Pfeifer Realty Group: Efficiency Produces Results

We've helped 227 families find their next chapter this year. When you're ready, we're here. Why Work with Pfeifer Realty Group? When it comes to buying or selling your home, choosing the right real estate partner can make all the difference. Pfeifer Realty Group has established itself as the leadi

Read More

Housing Growth in Lee County

Lee County Leads Southwest Florida in Housing Growth: A Look at the Region’s Major New Developments Lee County continues to lead the way in new construction across Southwest Florida. In April 2025, the county issued 994 single-family building permits, a number that accounts for the vast majority of

Read More

Understanding the 80% Rule in Homeowners Insurance

What Is the 80% Rule in Homeowners Insurance? As a buyer, understanding the details of your future home's insurance requirements can help you avoid unexpected costs, and one important concept to know is the 80% rule in property insurance. What Is the 80% Rule? The 80% rule refers to how much insuran

Read More

Pfeifer Realty On-going Community Service

Pfeifer Realty Group: A Legacy of Giving Back Realtors sell real estate… sounds simple… but it's so much more. At Pfeifer Realty Group, we believe real estate is about more than just buying and selling property. It’s about being part of something greater—a neighborhood, a community, and a shared com

Read More

Pfeifer's Fifth Open House Parade

Pfeifer's Fifth Open House ParadeApril 13th, 2025 | 11 AM - 2 PM Back by popular demand, Pfeifer Realty Group is hosting another Open House Parade on Sunday, April 13th, from 11 AM to 2 PM. This is a great opportunity to tour multiple homes in one day and explore a variety of properties available in

Read More

Sanibel Island – A Story of Resilience & Renewal

Sanibel Island has always been a place where time slows, nature flourishes, and unforgettable memories are created. Generations of visitors have been drawn to its serene beauty, from its unspoiled beaches to its vibrant wildlife. But beyond its scenic charm, Sanibel has proven to be a symbol of resi

Read More

Sanibel & Captiva Inventory: More Than Meets the Eye

The number of properties for sale on Sanibel and Captiva isn’t a mystery. It’s a story written over time, and the data tells it best. We often hear statements like, "there sure are a lot of homes for sale on Sanibel and Captiva," or conversely, "the inventory is so low that there aren't enough homes

Read More

Pfeifer's Fourth Open House Parade

Pfeifer's Fourth Open House ParadeMarch 16th, 2025 | 11 AM - 2 PM Back by popular demand, Pfeifer Realty Group is hosting another Open House Parade on Sunday, March 16th, from 11 AM to 2 PM. This is a great opportunity to tour multiple homes in one day and explore a variety of properties available i

Read More

Pfeifer's Third Open House Parade

1730 Jewel Box Drive 1062 South Yachtsman 544 Sea Oats 1425 Causey Court 640 Periwinkle Way 4988 Joewood Drive 1605 Middle Gulf Drive #126 5681 Baltusrol Court #2B 1543 San Carlos Bay Drive 4596 Buck Key Road 848 Angel Wing Drive 946 Whelk Drive 1158 Golden Olive Court 803 Lindgren Boulevard 727 Per

Read More

Pfeifer's 2024 Top Producers

Pfeifer Realty Group's 2024 Top Producers – Celebrating Excellence in Real Estate As we wrap up another successful year, we’re proud to recognize the agents who consistently delivered outstanding results. Their dedication, expertise, and commitment to exceptional service have set them apart. 2

Read More

Trusted Vendor List

The Pfeifer Team’s Trusted Vendor List At Pfeifer Realty Group, we understand that buying or selling a home involves much more than just real estate transactions. That’s why we maintain a comprehensive in-house list of trusted service providers to assist with various needs, from window cleaning to h

Read More

Lee County's Economic Growth & Development: A Look Ahead

The Pfeifer Team had the opportunity to meet with Lee County Economic Development Director John Talmage in Q4 2023 to discuss the county’s rapid expansion. With Fort Myers ranked as the fastest-growing city in the U.S. and Cape Coral attracting hybrid workers, Lee County is in the midst of a transfo

Read More

Avoiding Real Estate Pitfalls with Pfeifer Realty Group's Advisors

Introduction Purchasing a home is not just a financial transaction for most, but a milestone that comes with excitement and, understandably, some apprehension and reservation. At Pfeifer Realty Group, our buyer’s agents are dedicated to navigating you through the complexities of buying in Southwest

Read More

Navigating New Real Changes in SW Florida

The Upcoming Changes to the Real Estate Industry Many of our clients have been curious about the recent proposed changes in the real estate transaction laws. Our first piece of advice - Don't get caught up in the media frenzy. It's important to understand these changes and how they could affect both

Read More

Categories

Recent Posts